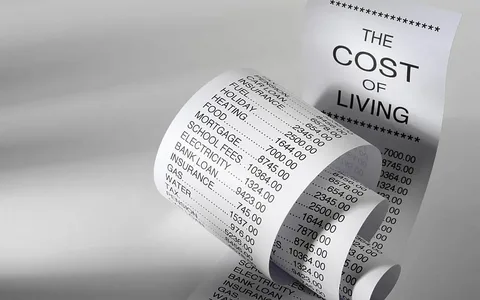

Cost of Living Considerations for Job Offers

When evaluating job offers, especially in different cities or countries, understanding the cost of living is crucial. Many professionals focus primarily on salary, but the overall compensation package should include a thorough assessment of living expenses. This blog will explore the various factors influencing the cost of living, helping you make informed decisions when considering job offers.

Understanding Cost of Living

Cost of living refers to the amount of money required to maintain a certain standard of living in a specific location. This includes housing, transportation, food, healthcare, and other daily expenses. When comparing job offers, it’s essential to assess how far a salary will stretch in different environments.

Housing Costs

Housing is typically the largest expense for individuals and families. Rent or mortgage rates can vary significantly between cities. For example, a salary that seems substantial in a small town may not suffice in a major city like New York or San Francisco, where housing costs can be exorbitant. It’s important to research average rental prices or mortgage rates in the area to determine how much of your salary will go toward housing.

Transportation Expenses

Transportation is another critical factor in the cost of living. Depending on the city, you may need to budget for public transportation, gas, insurance, and car maintenance. In urban areas with robust public transit systems, commuting costs may be lower than in suburban areas where a personal vehicle is necessary. Always consider the accessibility of your workplace in relation to transportation options.

Food and Groceries

Grocery prices can vary widely based on location. In some areas, fresh produce and organic options may be more expensive, while others may offer lower prices due to competition among grocery stores. Dining out can also be significantly pricier in metropolitan areas compared to rural settings. Assessing food costs in the region is essential for a realistic view of your budget.

Healthcare Costs

Healthcare expenses can greatly impact your overall financial situation. Depending on your employer’s benefits, you may need to pay for health insurance, copays, and medications. Researching the average healthcare costs in the region can help you understand what to expect. Some cities may have more affordable healthcare options, while others may require higher out-of-pocket expenses.

Taxes and Deductions

Taxes can significantly affect your take-home pay. Different states and countries have varying tax rates, including income tax, sales tax, and property tax. Understanding the local tax implications can help you accurately compare job offers. For example, a higher salary in a high-tax state may not provide more disposable income than a lower salary in a state with no income tax.

Utilities and Other Bills

Don’t forget to consider utility costs, which can include electricity, water, gas, internet, and phone bills. These expenses can vary based on location and the size of your household. Larger cities may have higher utility costs due to increased demand, while smaller towns may offer more affordable options.

Quality of Life

Cost of living isn’t just about numbers; it’s also about quality of life. Consider factors such as access to parks, recreational activities, cultural amenities, and community services. A job that pays well in a high-cost city may lead to a less fulfilling lifestyle if it limits your ability to enjoy these aspects of life.

Relocation Expenses

If the job requires you to relocate, factor in moving expenses. This could include hiring a moving company, travel costs, temporary housing, and any fees associated with ending your current lease. Some employers offer relocation packages, so be sure to ask about this during negotiations.

Comparing Job Offers

When evaluating multiple job offers, create a detailed cost-of-living comparison. Use online calculators or resources to analyze expenses in each location. This will help you assess how salary differences will impact your financial situation.

Negotiating Salary and Benefits

Understanding the cost of living can empower you during salary negotiations. If you’re moving to a city with a significantly higher cost of living, use this information to negotiate a more competitive salary. Additionally, consider asking for relocation assistance, flexible working options, or other benefits that could ease the financial burden of moving.

Long-Term Financial Goals

Consider how the cost of living impacts your long-term financial goals. A job with a lower salary but a significantly lower cost of living might allow you to save more in the long run compared to a higher-paying job in a high-cost area. Reflect on your financial priorities, such as saving for retirement, buying a home, or pursuing further education.

Seeking Local Insights

Before making a final decision, seek insights from locals or recent transplants. Online forums, social media groups, or networking events can provide valuable information about living in a specific area. Learning about others’ experiences can help you gauge the reality of living costs and lifestyle in a new location.

Conclusion: Making Informed Decisions

When considering job offers, it’s essential to factor in the cost of living to make an informed decision. Evaluating housing, transportation, food, healthcare, taxes, utilities, and overall quality of life will provide a clearer picture of how far your salary will go. Understanding these aspects can empower you to negotiate effectively and choose a job that aligns with your financial goals and lifestyle aspirations.

By approaching job offers with a comprehensive view of the cost of living, you can ensure that your next career move supports both your professional ambitions and personal well-being. Remember, it’s not just about the salary; it’s about finding a balance that allows you to thrive in your new environment.

One thought on “Cost of Living Considerations for Job Offers”